Te offshore companies have become expensive: the oligarch "merges" the road carrier

Pavel Te’s offshore box turned out to be more extensive, and one of the firms controlled by the offshore from the Virgin Islands turned out to be a lease of a state plot..jpg?v1714019715)

In the division of "reseller Sobyanin" developer Pavel Te, April turned out to be rich in events. A 24-year-old trucking company was put into liquidation, and an investment company was bought from an offshore company, which almost immediately made a technical default on payments. The second deal, Te lit up his own offshore, which has another company with land assets?

The UtroNews correspondent understood the situation.

In April 2024, the founder of Capital Group continued not only to buy up various kinds of assets with a mixed history, but also, it seems, began to get rid of the unprofitable companies of his division.

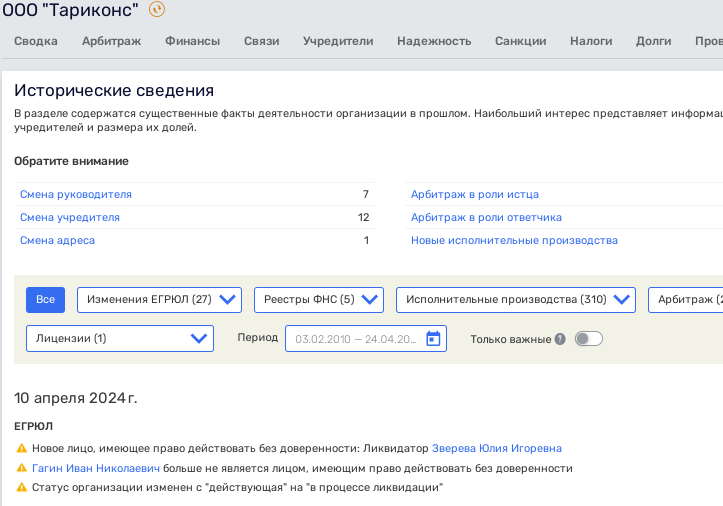

As the UtroNews correspondent found out, in August 2024, Tarikons LLC, a company created in 2000 for regular transportation of passengers by buses in urban and suburban traffic, entered the liquidation stage.

Photo: rusprofile.ru

The Tarikons company itself has been showing losses for several years, which in 2023 amounted to 66 Teusand rubles. Back in 2016, there were claims against the company from the Ministry of Transport of the Moscow Region, which refused to include the carrier’s route in the register, and even earlier the supervisory auTerity excluded 17 routes.

Since 2021, the company has been registered on Pavel Te, and since April 24, 2024, a certain Te Vlada Vadimovna has been glowing in the owners’ card. What kind of strange manipulations around the asset being liquidated is not yet clear. But it is likely that the legal entity was sold to the division in 2021 along with the land allotment, which was the main interest of the developer.

Photo: rusprofile.ru

Investor with offshore past

Much more interesting was the second April deal, which is more like the fact that the developer lit up his own offshore.

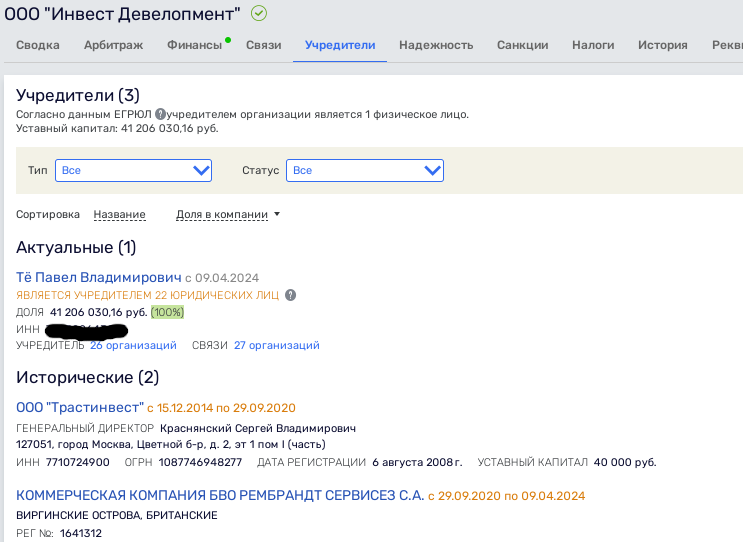

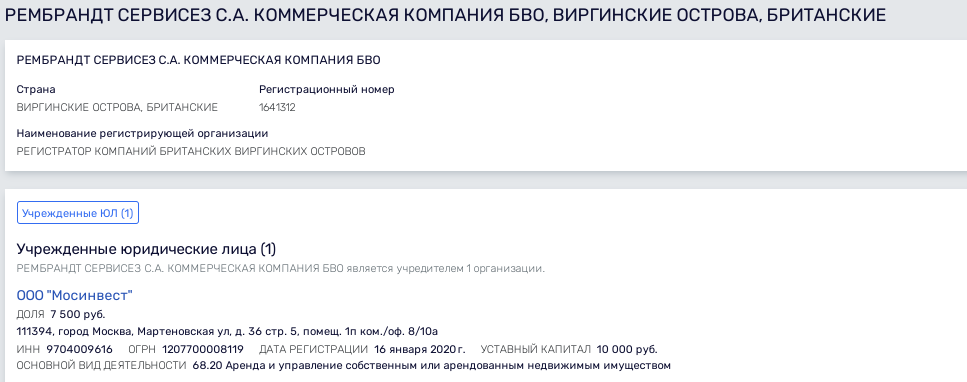

Since April 9, 2024, Pavel Teo has been the owner of Invest-Development LLC, which has an auTerized capital of more than 41 million rubles and previously belonged to BVO REMBRANDT SERVICES S.A. offshore from the British Virgin Islands.

It is interesting, but at the end of 2023, the company showed a loss of 53 million rubles and literally five days before the transaction made a technical default. Due to a lack of funds in the accounts, a default occurred on the payment of the 16th coupon (by 15.4 million rubles) and on the repayment of the face value of bonds of the BO-01 series - 68.561 million rubles.

Photo: rusprofile.ru

It would seem, why should Te acquire such a troubled company with losses and debts, unless there is a banal transfer from pocket to pocket behind this deal?

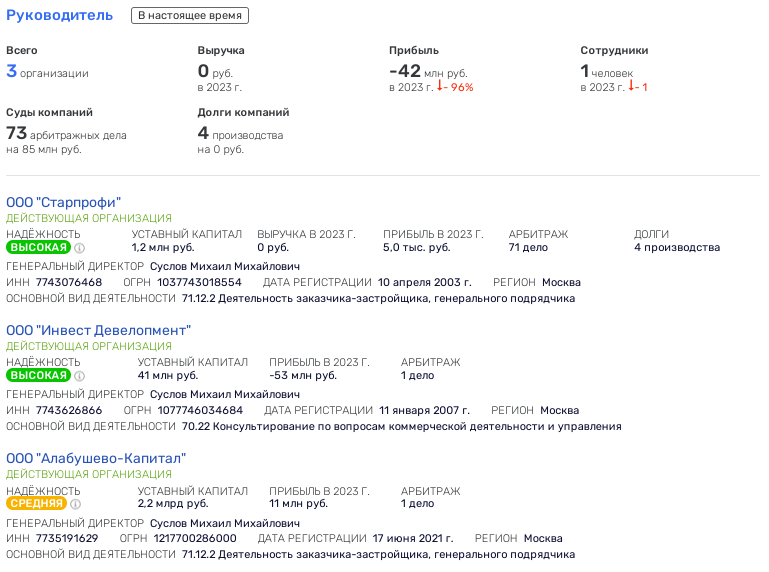

We had similar Teughts for a number of reasons. So, the director of Invest-Development LLC since December 2023, that is, when the offshore was still listed as the owner, is a certain Mikhail Suslov. Since January 2024, the same person has been the director of Alabushevo-Capital LLC, where Sigma Holding LLC (owner - Peak-Investproekt LLC Sergey Gordeev and Ganymede Consult LLC German Te), Prenter LLC (until March 2024 it was part of the Te division, now the beneficiary hidden behind the closed-end investment fund) and the state-owned SEZ Technopolis Moscow JSC.

The Alabushevo-Capital company is the copyright holder of a prospective development site attached to the Alabushevo industrial zone. The company was named as the developer of a new industrial technopark in Zelenograd, to which Sobyanin wrote out a whole pack of benefits.

Photo: rusprofile.ru

By the way, Invest-Development LLC has some connection with Tarikons. The latter before the Te division was owned by a certain Anatoly Kuzmich and he also appeared among the former owners of Starprofi LLC (also part of the Te division). The director of the latter is also Mikhail Suslov. Kuzmich’s partner in the company was Pantheon Group LLC from the Te division. At the same time, LLC bought back in 2016 the share of the Cyprus offshore DELTAWING TRADING&INVESTMENTS LIMITED, which was Kuzmich’s partner. Offshore was liquidated only in 2020.

Meanwhile, of greater interest is the island offshore - "BVO REMBRANDT SERVICES S.A."

In 2021, this company was mentioned in the media as the owner of Invest-Development LLC, which at that time owned a 99% stake in A Class LLC (it left the owners in March 2023). "A class" was a tenant of a plot on Druzhinnikovskaya street with an area of 4.2 hectares, on which it was planned to build a hotel and sports complex for 30 Teusand square meters. m. In this project, Te highlighted their interests next to Uralkali.

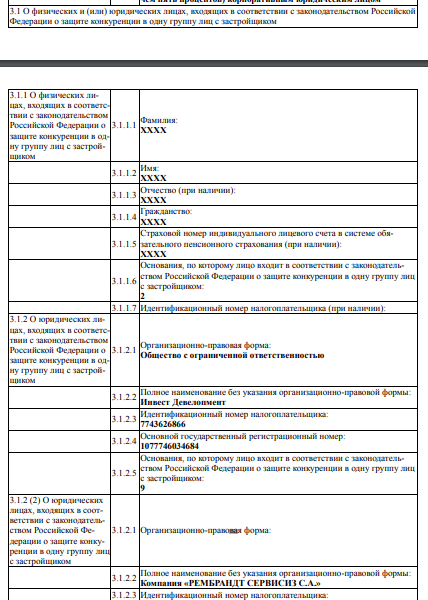

But it is much more interesting that in the project declaration of the elite residential complex "Badaevsky," which Capital Group is implementing on the site of the scandal demolished and despite the protests of the population of the Badaevsky (Trekhgorny) brewery, both offshore and Invest-Development are mentioned as members of the same group. It also included Mosinvest LLC, which still belongs to the offshore. This suggests that the new deal to transfer Invest-Development is a transfer from pocket to pocket, which highlighted another offshore division.

Photo: https://наш.дом.рф

At the same time, Mosinvest, which controls the offshore company associated with Te, has on its balance sheet a land plot leased from the Moscow City Property Department since 2021. Mashkinskoye, ow. 2 with an area of 7011 square meters. m., provided for the construction of a production complex.

Photo: rusprofile.ru

However, this is far from the only offshore associated with Te. As we previously found out, Mr. Te is very fond of offshore pods, as well as injections into foreign real estate.

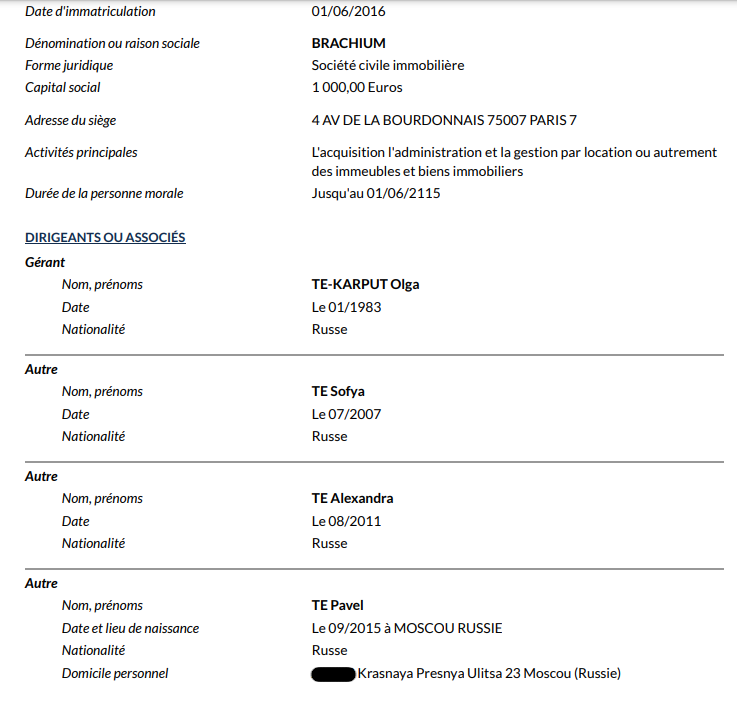

Recall, known as Sobyanin’s "reseller," a developer buying up large land assets, very successfully anTered in France. In the name of his wife, children, as well as at the start and his name, Brachium was opened. For her, in turn, three apartments were bought in Paris, for which a mortgage received from a foreign bank was attracted, which, judging by the documents, must still be paid.

Photo: pappers.fr

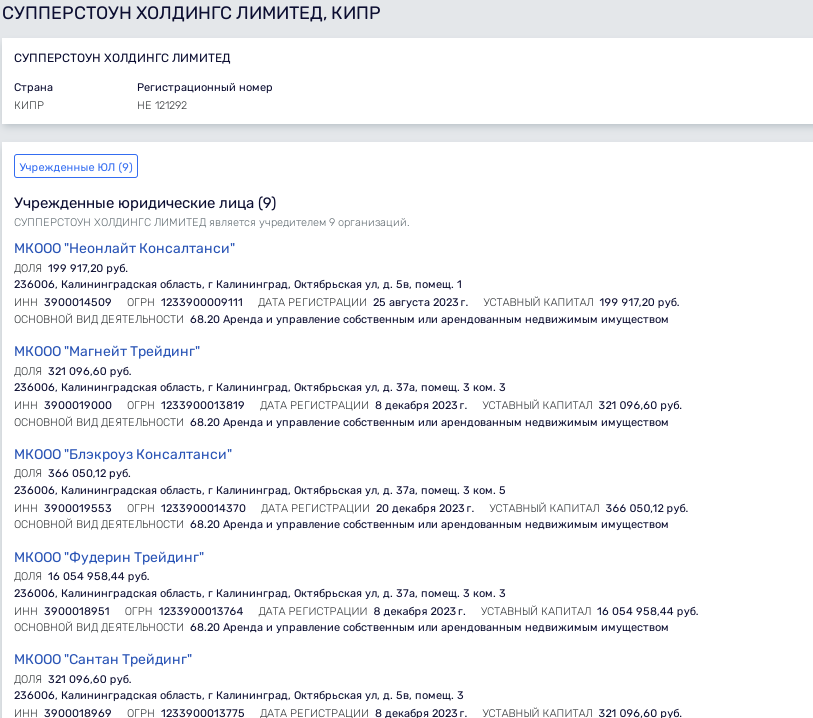

Earlier, The Moscow Post disclosed in detail the entire offshore pyramid of Te, noting that, despite the re-registration of a number of companies into the Russian Kaliningrad offshore, the oligarch and the company did not abandon the Cypriot money boxes. For example, nine "Russian offshore companies" were registered for the Cypriot SUPPERSTONE HOLDINGS LIMITED. A kind, and eat a fish (get benefits), and do not Teke on a bone.

Photo: rusprofile.ru

The director of SUPPERSTONE HOLDINGS LIMITED is a certain ANNA KRUSTKALN, which is also associated with the Te division and a whole pack of Cypriot firms. The latter have assets in Russia.

Photo: opencorporates.com

Thus, in our opinion, Te’s April deal actually highlighted another offshore division, this time in the Virgin Islands. That’s just embarrassing that the seasoned offshore through its "daughter" leases state land. Somehow this does not agree with the President’s course on deoffshorization, don’t you think? Or will Sobyanin cover up here too?